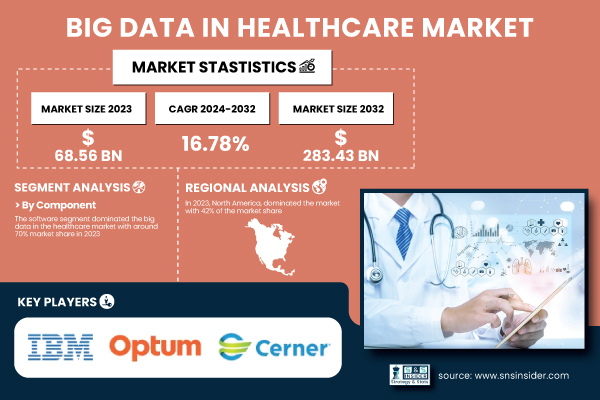

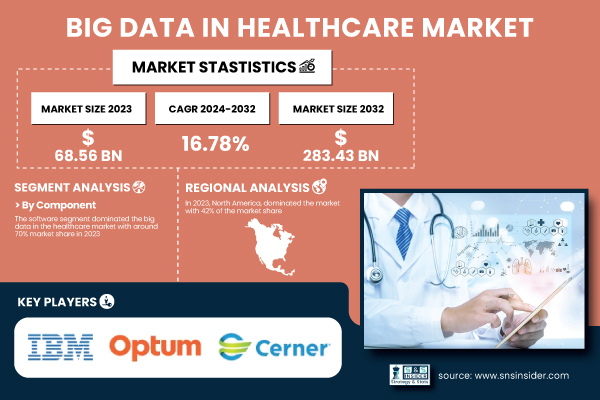

Austin, April 19, 2025 (GLOBE NEWSWIRE) -- Big Data in Healthcare Market Size & Growth Analysis: According to the latest research by SNS Insider, the Big Data in Healthcare Market size was valued at USD 68.56 billion in 2023, is anticipated to reach USD 283.43 billion by 2032, growing at a CAGR of 16.

78% during 2024-2032. This surge is fueled by the critical need for the delivery of cost-effective healthcare, real-time patient monitoring, and clinical decision support systems through advanced analytics. For operation efficiency, better patient outcomes, and disease prediction, hospitals and health systems all over the globe are implementing data-driven technologies on-site.

The United States Big Data in Healthcare Market was USD 22.46 billion in 2023, and anticipated to reach USD 85.50 billion by 2032, at a CAGR of 15.

71% from 2023 to 2032. Get a Sample Report of Big Data in Healthcare Market@ https://www.snsinsider.

com/sample-request/5554 This position has been accomplished through widespread implementation of EHRs, heavy investments in healthcare IT infrastructure, and national programs that continue to unfold, such as the HITECH Act and the Medicare EHR Incentive Program, that are positioned to drive long-term digital healthcare transformation in the U.S. In 2023, more than 96% of hospitals in the U.

S. used certified EHR systems, according to the Office of the National Coordinator for Health Information Technology. The market's expansion is driven by increasing demand for personalized medicine, preventive care, and real-time analytics.

The advent of AI, machine learning, and IoT-enabled medical devices means huge amounts of data are now processed to predict the paths of diseases, optimize resources in a hospital, and cut costs. To develop infrastructure that can additionally accommodate structured and unstructured healthcare data, governments and private institutions are making huge investments. In 2023, for example, the U.

S. Department of Health and Human Services announced USD 100 million in funding to enhance data interoperability and care outcomes across providers. Key Big Data in Healthcare Companies Profiled in the Report IBM Corporation (IBM Watson Health, IBM Clinical Development) Optum (UnitedHealth Group) (OptumIQ, Optum Analytics) Cerner Corporation (HealtheIntent, PowerChart) Philips Healthcare (HealthSuite, IntelliSpace Precision Medicine) McKesson Corporation (McKesson Decision Support Analytics, McKesson Health Mart Atlas) Allscripts Healthcare Solutions (Allscripts Analytics, Sunrise EHR) Epic Systems Corporation (Epic Cosmos, MyChart) GE Healthcare (Edison Health Services, Centricity Analytics) Oracle Corporation (Oracle Health Management, Oracle Healthcare Foundation) SAS Institute Inc.

(SAS Health Analytics, SAS Visual Analytics) Microsoft Corporation (Microsoft Azure Healthcare API, Microsoft Cloud for Healthcare) Amazon Web Services (AWS) (AWS HealthLake, AWS Comprehend Medical) Google (Google Cloud) (Google Cloud Healthcare API, BigQuery for Healthcare) Siemens Healthineers (teamplay Digital Health Platform, AI-Rad Companion) Cognizant Technology Solutions (Cognizant Healthcare Data Analytics, Trizetto) Medtronic plc (CareLink Network, Medtronic Analytics Solutions) IQVIA (IQVIA CORE, Orchestrated Patient Engagement) Dell Technologies (Dell EMC Elastic Cloud Storage, Dell EMC Isilon) Hewlett Packard Enterprise (HPE) (HPE Ezmeral, HPE GreenLake for Healthcare) Tableau (a Salesforce Company) (Tableau for Healthcare, Tableau Prep) Big Data in Healthcare Market Report Scope Segment Analysis By Component The software segment accounted for nearly 70% of the total market share in 2023, mainly owing to the growing demand for platforms that facilitate big data ingestion, storage, visualization, and analytics. These platforms assist hospitals in managing structured and unstructured content sourced from EHRs, medical imaging, lab systems, and IoT devices. Integrated analytics applications enable clinicians to conduct patient journeys, predict disease outbreaks, and accelerate administration processes.

The increased adoption of cloud-native platforms and interoperability standards, such as HL7 and FHIR, improve the scale and flexibility of software tools as they take hold across public and private health systems alike. As AI integration & data visualization as a way to deliver care becomes the norm, the software segment is poised to remain the backbone of big data operations throughout the forecast period. By Spender In 2023, the healthcare payer segment led the market, capturing 64% of the market share.

Public and private insurance companies increasingly use big data analytics for fraud detection, risk stratification, claims management, and patient cost modeling. Payers employ predictive tools to assess chronic disease risks and customize health plans, improving care outcomes and reducing financial exposure. Additionally, government payers such as Medicare and Medicaid employ analytics platforms for population health management and cost-effectiveness analysis.

With the proliferation of value-based reimbursement models, payers are pouring money into analytics to measure quality metrics, improve provider networks, and manage healthcare costs. They go beyond simply offering a solution, though; they understand big data and use it to create efficiency and to reduce claims fraud, further establishing them as leaders in the big data space. By Tool The predictive analytics segment dominated the Big Data in Healthcare Market in 2023.

Predictive models are also being used to anticipate patient admissions, equipment needs, sepsis detection, and chronic condition management by hospitals and other healthcare providers. These tools integrate historical patient data, genetic profiles, and real-time clinical markers to generate actionable insights. As diseases such as cancer, diabetes, and mental health disorders continue to rise, predictive analytics enables providers to move beyond reactive and deliver proactive care.

Tools that monitor early cancer detection are emerging as the next frontier, particularly in the detection of breast, cervical, and colorectal cancer in high-risk populations such as prostate cancer patients in the U.S. For A Detailed Briefing Session with Our Team of Analysts, Connect with Us Now@ https://www.

snsinsider.com/request-analyst/5554 Big Data in Healthcare Market Segmentation By Component Software Services By Spender Healthcare Provider Healthcare Payer By Tool Financial Analytics Data Warehouse Analytics CRM Analytics Production Reporting Visual Analytics Predictive Analytics Supply Chain Analytics Risk Management Analytics Test Analytics Others By Application Access Clinical Information Access Transactional Data Access Operational Information Others By Deployment On-premises Cloud-based Regional Analysis North America commanded the largest share of the total market, accounting for 42% of the global Big Data in Healthcare Market in 2023. This is largely due to widespread EHR adoption, a mature healthcare IT infrastructure, and ongoing government investments.

The US is at the forefront of advanced clinical analytics, telehealth expansion, and data-driven public health strategies. Policies including the HITECH Act, 21st Century Cures Act, and ONC’s interoperability roadmap have also driven the incorporation of big data tools into clinical workflows. Moreover, U.

S. tech giants such as Amazon, Google, and Microsoft are deeply engaged in changing healthcare data systems. Publications Whereas, as personalized medicine and regulatory interest in patient outcomes continue to push innovation and investment in healthcare analytics, North America will remain the hub for innovation and investment in healthcare analytics.

Moreover, Asia Pacific is anticipated to register the fastest CAGR from 2024 to 2032 owing to the rapid digitization of the healthcare system in countries, such as India, China, Japan, and South Korea. Demographic trends of a fast-aging population, increasing disease burden, and growing health expenditure are forcing public and private providers to adopt AI-powered diagnostics and analytics tools. Startups and multinational firms are investing heavily in the region’s healthcare data ecosystem, signaling long-term growth potential.

Recent Developments in the Big Data in Healthcare Market In February 2024, Microsoft and Epic Systems expanded their collaboration to bring generative AI to healthcare workflows, leveraging Azure OpenAI Service for advanced analytics and clinical decision support. In January 2024, IBM Watson Health rebranded as Merative and launched cloud-native big data solutions to accelerate pharmaceutical R&D and improve clinical trial efficiency. Table of Contents – Major Key Points 1.

Introduction 2. Executive Summary 3. Research Methodology 4.

Market Dynamics Impact Analysis 5. Statistical Insights and Trends Reporting 6. Competitive Landscape 7.

Big Data in Healthcare Market by Component 8. Big Data in Healthcare Market by Spender 9. Big Data in Healthcare Market by Tool 10.

Big Data in Healthcare Market by Application 11. Big Data in Healthcare Market by Deployment 12. Regional Analysis 13.

Company Profiles 14. Use Cases and Best Practices 15. Conclusion Related Reports by SNS Insider Healthcare Analytics Market AI in Healthcare Market Healthcare IT Market Electronic Health Records (EHR) Market Population Health Management Market About Us: SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally.

Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world..

Business

Big Data in Healthcare Market Size to Reach USD 283.43 Billion by 2032, Fueled by AI and Predictive Analytics — SNS Insider

According to Research by SNS Insider, the Big Data in Healthcare Market growth is driven by personalized medicine, real-time analytics, and digital health transformation. According to Research by SNS Insider, the Big Data in Healthcare Market growth is driven by personalized medicine, real-time analytics, and digital health transformation.