Bank of Japan watchers forecast a delay in interest-rate hikes and a lower level at the end of the cycle after US President Donald Trump’s tariff measures darkened the economic outlook, according to a Bloomberg survey. Author of the article: You can save this article by registering for free here . Or sign-in if you have an account.

(Bloomberg) — Bank of Japan watchers forecast a delay in interest-rate hikes and a lower level at the end of the cycle after US President Donald Trump’s tariff measures darkened the economic outlook, according to a Bloomberg survey. Subscribe now to read the latest news in your city and across Canada. Subscribe now to read the latest news in your city and across Canada.

Create an account or sign in to continue with your reading experience. Create an account or sign in to continue with your reading experience. Sign In or Create an Account All 54 economists see no policy change at the two-day meeting ending on May 1, according to the poll.

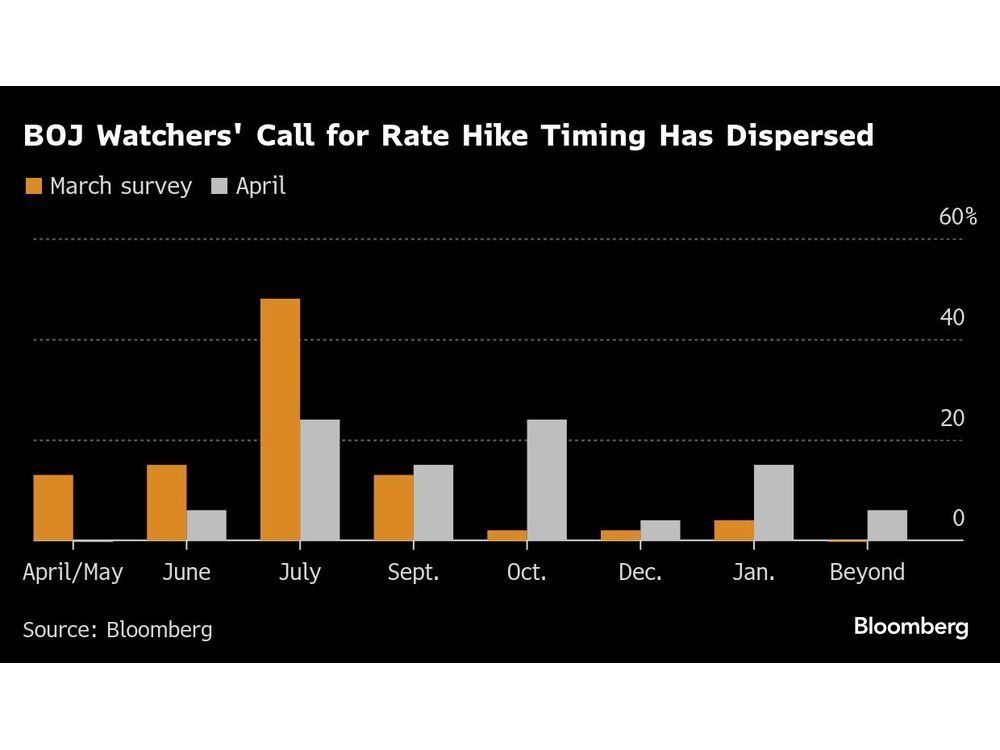

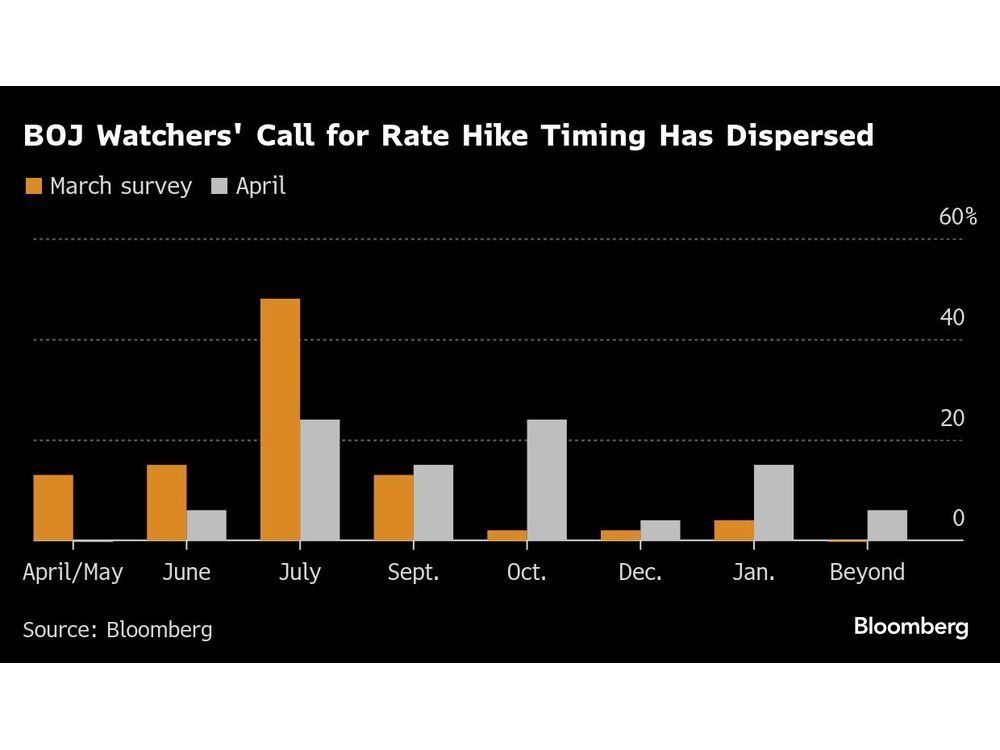

Those expecting a hike by September plunged to 45% from 89% in the previous survey. July and October were the most popular choices for the next move at about 25% each, while those anticipating a January increase almost quadrupled to 15%. The analysts’ view for the terminal rate this cycle dropped back to 1% after rising to 1.

25% in the March survey, indicating they expect two more hikes from the current benchmark rate of 0.5%. Get the latest headlines, breaking news and columns.

By signing up you consent to receive the above newsletter from Postmedia Network Inc. A welcome email is on its way. If you don't see it, please check your junk folder.

The next issue of Top Stories will soon be in your inbox. We encountered an issue signing you up. Please try again Interested in more newsletters? Browse here.

The survey results, with more dispersed rate-hike expectations, reflect the intensified uncertainties the central bank, led by Governor Kazuo Ueda, must now confront after three hikes since March of last year. Some 83% of the respondents see a chance the BOJ refrains from hiking at all over the rest of 2025 due to impact of the US tariffs. “The BOJ must pay great attention to downside risks for the economy, and the chance of a slowdown is high,” Ryutaro Kono, chief Japan economist at BNP Paribas, wrote in a survey response.

“The likelihood of an additional hike has gone down for this year.” For full results of the survey, click here. Some 90% said that US tariff measures would push back the timing of the BOJ’s rate hikes and almost 70% said that Japan’s economy may fall into a recession, according to the survey.

At the same time, most analysts, including BNP Paribas’ Kono, said they expect the central bank to maintain its stance for normalization, partly due to US pressure on Japan not to intentionally weaken the yen. The BOJ is also contending with persistent inflationary pressure, with consumer price gains running at or above its 2% target for around three years. “I don’t think they will throw in the towel to ditch normalization,” Mari Iwashita, a veteran BOJ watcher and former executive economist at Daiwa Securities, said.

“There is still a possibility that a rate hike is brought forward depending on the views of the US administration.” Trump has previously warned against manipulating the yen to benefit trade. Treasury Secretary Scott Bessent and his Japanese counterpart Katsunobu Kato are expected to meet in Washington this week, and currency traders will closely follow their remarks.

The yen has strengthened rapidly against the US dollar over the past month as demand for safe-haven assets surged. The shift would ease inflationary pressures in Japan, which relies heavily on energy, food and goods imports. The yen’s gains could also eat into profits at large companies, which have agreed to the biggest wage increases in more than three decades in the last two years.

“I don’t think that the BOJ will bring forward its rate-hike timing as that could accelerate the yen’s appreciation too much,” said Yuki Masujima, principal economist at Deloitte Tohmatsu Financial Advisory. “A strong yen would lower corporate profits and inbound spending.” The yen hit a seven-month high of 139.

89 per dollar earlier this week. The median level of the currency that would stoke BOJ caution about a rate hike is 130, according to the survey. With the central bank widely expected to hold rates steady on May 1, BOJ watchers will pay greater attention to the quarterly economic report released alongside the policy statement.

Economists expect a downgrade in the growth forecast for fiscal year 2025 to 0.7% from 1.1% previously, with the rest of the projections more or less the same as three months ago, according to the survey.

Postmedia is committed to maintaining a lively but civil forum for discussion. Please keep comments relevant and respectful. Comments may take up to an hour to appear on the site.

You will receive an email if there is a reply to your comment, an update to a thread you follow or if a user you follow comments. Visit our Community Guidelines for more information..

Top

BOJ Watchers Expect Delay in Rate Hikes With Lower Terminal Rate

Bank of Japan watchers forecast a delay in interest-rate hikes and a lower level at the end of the cycle after US President Donald Trump’s tariff measures darkened the economic outlook, according to a Bloomberg survey.