Oil ticked higher after a volatile week as traders parsed the latest signals in the trade war, prepared for details of how China aims to support its economy, and weighed geopolitical developments in Iran. Author of the article: You can save this article by registering for free here . Or sign-in if you have an account.

(Bloomberg) — Oil ticked higher after a volatile week as traders parsed the latest signals in the trade war, prepared for details of how China aims to support its economy, and weighed geopolitical developments in Iran. Subscribe now to read the latest news in your city and across Canada. Subscribe now to read the latest news in your city and across Canada.

Create an account or sign in to continue with your reading experience. Create an account or sign in to continue with your reading experience. Sign In or Create an Account Brent climbed above $67 a barrel after dipping 1.

6% last week, while West Texas Intermediate was near $63. Treasury Secretary Scott Bessent told ABC News that talks were ongoing with US trading partners, and “some of those are moving along very well, especially with the Asian countries.” In China — the world’s largest crude importer, and economy subject to the harshest US levies — officials plan to hold a press conference later Monday about measures to stabilize employment and ensure stable growth.

Get the latest headlines, breaking news and columns. By signing up you consent to receive the above newsletter from Postmedia Network Inc. A welcome email is on its way.

If you don't see it, please check your junk folder. The next issue of Top Stories will soon be in your inbox. We encountered an issue signing you up.

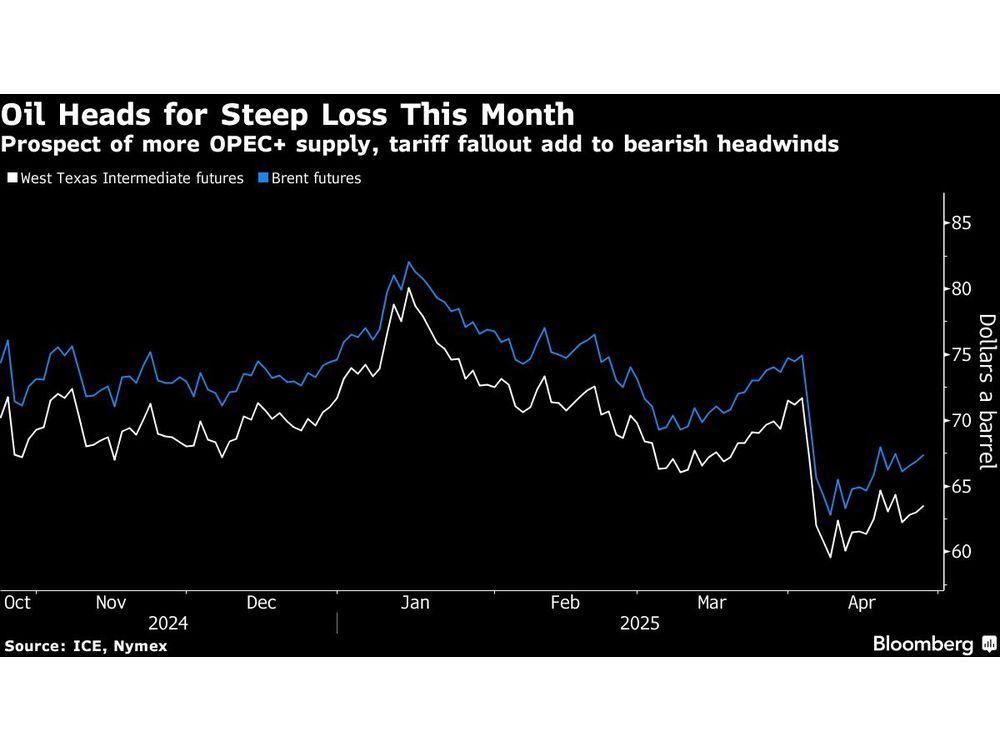

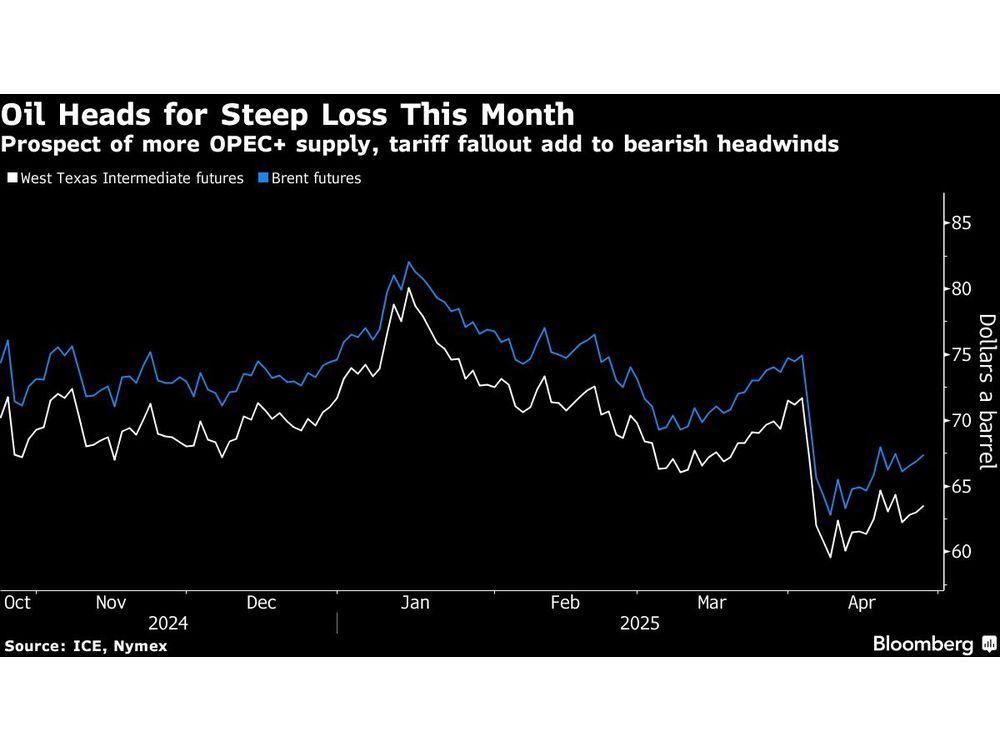

Please try again Interested in more newsletters? Browse here. Oil is headed for the biggest monthly loss since 2022 after touching a four-year low. Futures have been burdened by concerns that the US-led trade war will stifle economic activity and hurt energy demand.

At the same time, the OPEC+ cartel has compounded bearish sentiment by ramping up idled production. The group will meet on May 5 to discuss output plans for June. On the geopolitical front, the US and Iran reported signs of progress in talks on a deal over Tehran’s nuclear program, and the two sides agreed to meet again in Europe.

Separately, an explosion at the nation’s Shahid Rajaee port on Saturday left dozens dead. The major hub has a strategic location on the Strait of Hormuz, a key conduit for the global oil trade. Elsewhere at the weekend, Ukrainian President Volodymyr Zelenskiy held a one-on-one meeting with Donald Trump.

Afterward, the US president said his Russian counterpart, Vladimir Putin, may be stalling to avoid ending the war and suggesting further sanctions might be needed. Postmedia is committed to maintaining a lively but civil forum for discussion. Please keep comments relevant and respectful.

Comments may take up to an hour to appear on the site. You will receive an email if there is a reply to your comment, an update to a thread you follow or if a user you follow comments. Visit our Community Guidelines for more information.

.

Top

Oil Ticks Higher With Trade War and China’s Outlook to the Fore

Oil ticked higher after a volatile week as traders parsed the latest signals in the trade war, prepared for details of how China aims to support its economy, and weighed geopolitical developments in Iran.