New Delhi: The World Bank on Wednesday lowered India’s growth forecast for the current fiscal by 4 percentage points to 6.3 per cent amid global economic weakness and policy uncertainty. In its previous estimate, the World Bank had projected India’s growth at 6.

7 per cent for the fiscal year 2025-26. In India, growth in FY24/25 disappointed because of slower growth in private investment and public capital expenditures that did not meet government targets, the World Bank said in its twice-yearly regional outlook. “In India, growth is expected to slow from 6.

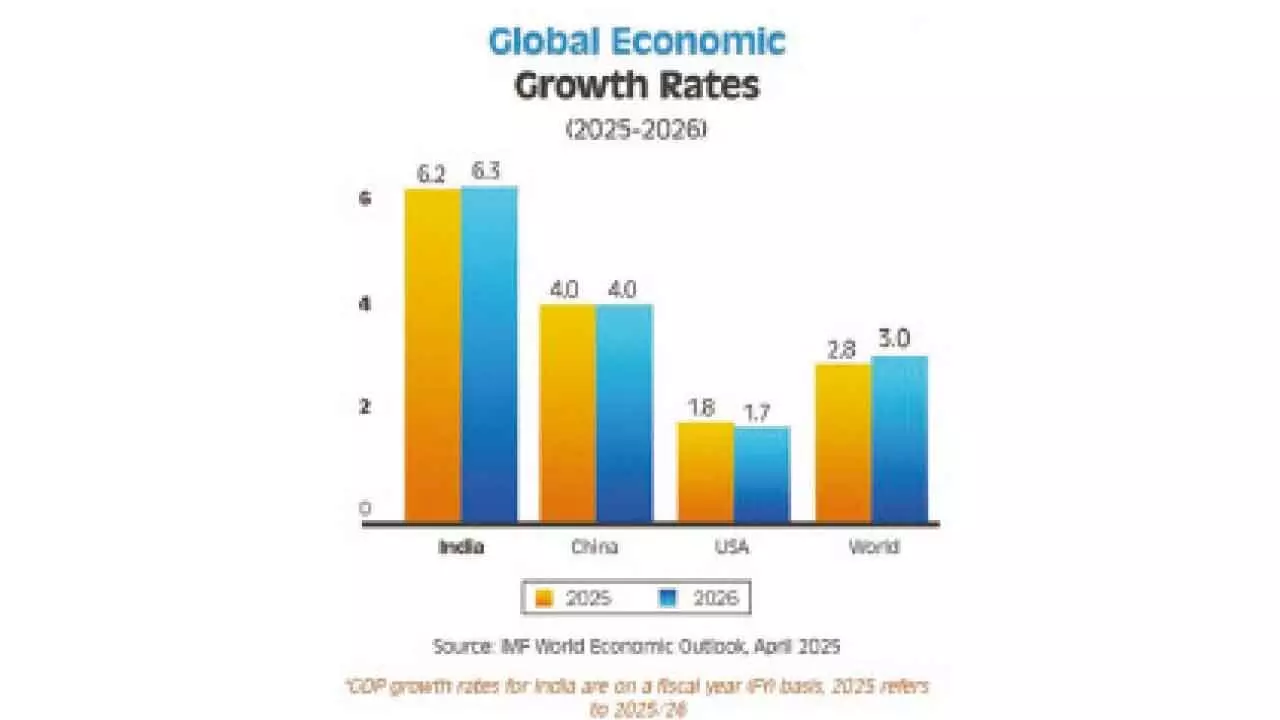

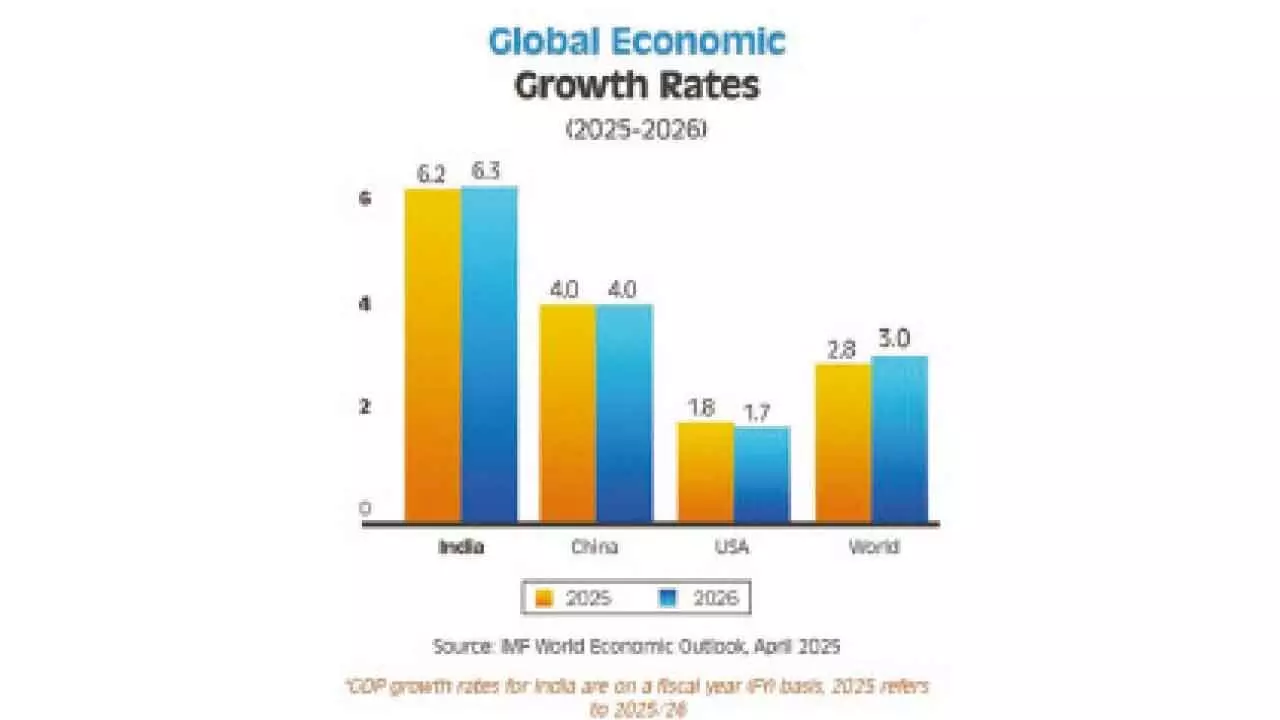

5 per cent in FY24/25 to 6.3 per cent as in FY25/26 as the benefits to private investment from monetary easing and regulatory streamlining are expected to be offset by global economic weakness and policy uncertainty,” said its South Asia Development Update, Taxing Times. On Tuesday, the International Monetary Fund (IMF) also lowered India’s GDP forecast for the current fiscal to 6.

2 per cent from its January estimates of 6.5 per cent. The World Bank report said the benefits to private investment from monetary easing and regulatory streamlining are expected to be offset by global economic weakness and policy uncertainty.

“Private consumption is expected to benefit from tax cuts, and the improving implementation of public investment plans should boost government investment, but export demand will be constrained by shifts in trade policy and slowing global growth,” it said. It further said that amid increasing uncertainty in the global economy, South Asia’s growth prospects have weakened, with projections downgraded in most countries in the region. Stepping up domestic revenue mobilisation could help the region strengthen fragile fiscal positions and increase resilience against future shocks, it said.

The Washington-headquartered multilateral agency has projected regional growth to slow to 5.8 per cent in 2025, 0.4 percentage points below October projections before ticking up to 6.

1 per cent in 2026. This outlook is subject to heightened risks, including from a highly uncertain global landscape, combined with domestic vulnerabilities, including constrained fiscal space..

Business

World Bank trims India’s GDP growth to 6.3% in FY26

Cites global economic weakness, policy uncertainty