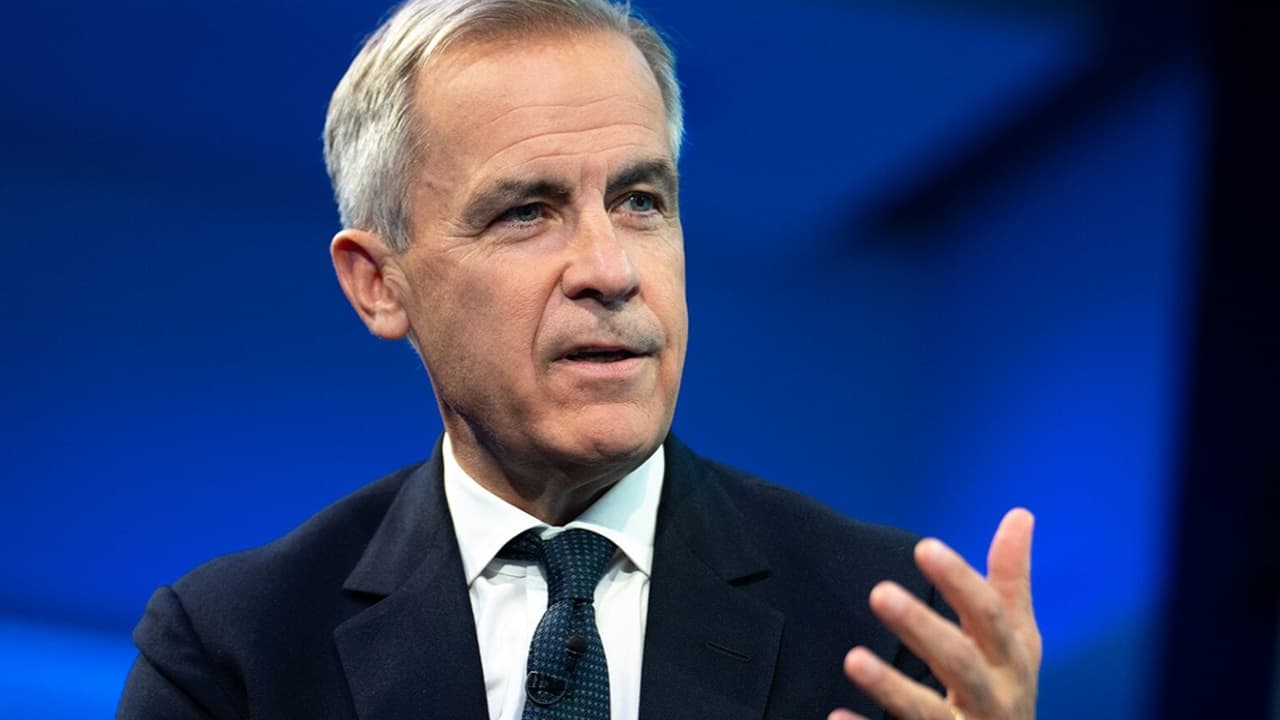

The election of Mark Carney as Canada’s prime minister has rekindled optimism around Canadian pension fund investments in India, with analysts and investment advisers expecting him to ease diplomatic tensions that have cast a shadow on bilateral economic cooperation in recent years. Prime Minister Narendra Modi congratulated Carney and said, “I look forward to working with you to strengthen our partnership and unlock greater opportunities for our people." Relations between the two countries deteriorated significantly during Justin Trudeau’s tenure, hitting a new low in 2024 when he alleged Indian government’s involvement in the killing of Hardeep Singh Nijjar, a Canadian Sikh separatist.

The allegation, strongly denied by India, led to tit-for-tat expulsions of diplomats and a temporary suspension of Indian visa services for Canadian citizens. Though Canadian pension funds like CPP Investments and CDPQ maintained their presence in India, the political friction introduced a layer of caution to their investment strategies. Along with CPP Investments and CDPQ, Canadian funds such as OMERS, British Columbia Investments, PSP Investments are major investors in India economy, not just in the markets but also in critical areas such as infrastructure and renewable energy.

Moneycontrol, citing data from the London Stock Exchange Group (LSEG), reported in October that Canadian pension funds and private investors like Brookfield Asset Management and Fairfax Financial collectively invested around $21 billion in India over the past five years, including during the disruptions caused by the COVID-19 pandemic. Hitting refresh Now, with Carney signalling a reset in bilateral ties, the sentiment around the flow of Canadian pension fund capital into India is looking more optimistic, industry experts said. Mohit Gulati, Managing Partner and CIO at ITI Growth Opportunities Fund, said Carney’s election could unlock a new phase of investment flows.

“With Prime Minister Mark Carney underscoring the strategic importance of India-Canada partnership, there is considerable scope for renewed and expanded capital flows—especially if diplomatic tensions subside,” he said. “An improved diplomatic climate could prompt not just continued but significantly increased allocations to India, aligning with India’s need for long-term growth capital.” According to Gulati, Canadian pension funds already manage more than $55 billion in Indian assets across infrastructure, real estate, and energy.

He added that a stronger diplomatic footing under Carney could further accelerate this momentum, especially among Tier-2 Canadian funds that had so far been more cautious. Sudhir Dash, the founder and CEO of Unaprime Investment Advisors, said the change in leadership would remove lingering doubts among Canadian investors. “The previous government’s foreign policies had set some doubt in the mind of Canadian funds, both pension and non-pension.

The change in government will put all those doubts to rest, allowing funds to take their investment calls without any apprehension or potential fallout,” Dash said. Kranthi Bathini, director of equity strategy at WealthMills Securities, expressed a similar sentiment. “A change of government is definitely positive.

We expect bilateral relationships to soften, strengthening trade and investment ties. As the bonding between the two countries improves, we could see medium to long-term investments pick up pace,” he said. From Wall Street to Bank of Canada to PM The optimism expressed by analysts also stems from Carney’s professional background, which includes senior roles in institutions such as Brookfield and Goldman Sachs as well as the Governor of Bank of Canada and Bank of England, which experts believe would have exposed him to the trade and investment potential of India.

Carney served as vice chair at Brookfield Asset Management from August 2020 to January 2025. Brookfield is one of the biggest global alternative investment firms in India, second only to Blackstone, with investments across infrastructure, real estate and other sectors. Carney’s election, therefore, will not just result in a diplomatic thaw but also stronger strategic economic partnership, experts said.

.